Borrow DAI and USDS

Tutorial

On the Borrow DAI and USDS page, you can borrow USDS and DAI, by depositing crypto assets as collateral. If you wish to borrow other assets than USDS or DAI, navigate to the My portfolio page and follow the deposit assets and borrowing assets steps instead.

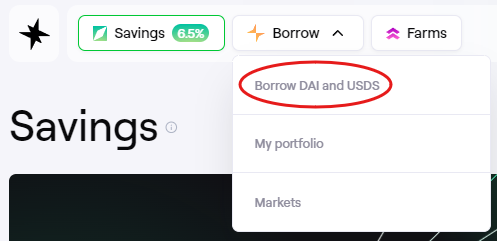

- Navigate to the Borrow DAI and USDS page.

Navigating to Borrow DAI and USDS

Navigating to Borrow DAI and USDS

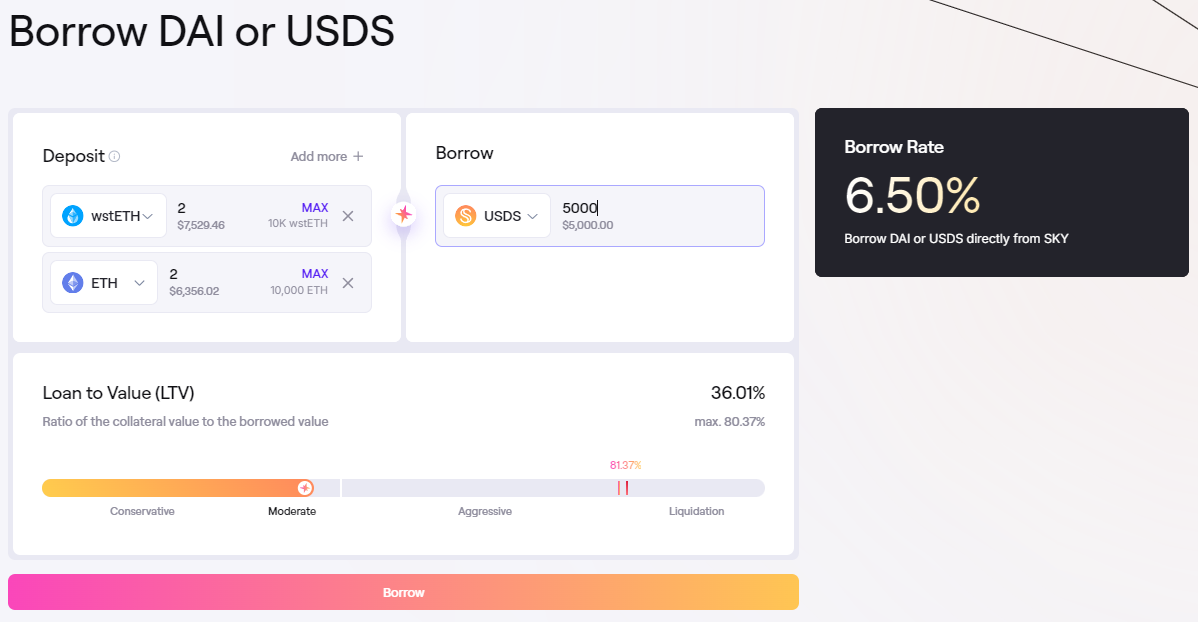

The Borrow DAI or USDS page

The Borrow DAI or USDS page

- Under Deposit you can select the crypto asset in the dropdown menu you wish to deposit as collateral for the loan.

Easy Borrow Flow

Easy Borrow Flow

- In the input bar on the left you specify the amount of collateral you wish to deposit, denominated in the asset. The dollar value is displayed below.

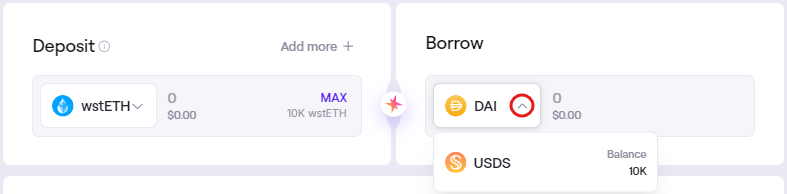

- On the right under Borrow, using the dropdown menu you can specify the asset you wish to borrow.

Selection of which asset to borrow.

Selection of which asset to borrow.

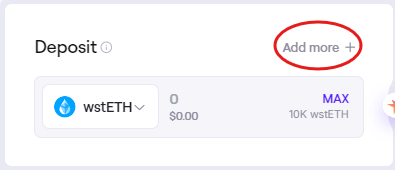

- Click on Add more + to add more crypto assets to be used as collateral. This will generate an additional deposit bar, where you can select the asset and amount.

Depositing multiple collateral assets

Depositing multiple collateral assets

- On the right side under Borrow, you specify the DAI or USDS amount you wish to borrow.

- Below you are able to see the simulated state of the borrow position based on the current price of the collateral assets and the borrow amount. It displays:

- Loan to Value (LTV): The percentage value of the borrow amount in USD in respect to the collateral amount in USD.

- The LTV slider: Shows the current LTV percentage and its associated risk level ranging from Conservative to Moderate to Aggressive. You can drag the slider to adjust the borrow amount to specify an LTV percentage, which will adjust the Dai borrow amount above accordingly.

- Liquidation Indicator: The LTV slider also shows the LTV at which the position can be liquidated. The different collateral assets have a different liquidation LTV. Creating a position with multiple collateral assets will use an aggregate liquidation LTV based on the amount of each collateral.

- Max LTV: The maximum allowed percentage value of the borrow amount in USD in respect to the collateral amount in USD.

- Borrow rate: The annual percentage rate (APR) for borrowing. For USDS and DAI, this rate is set by Sky Governance.

-

Once the parameters for the borrow position has been set, you click Borrow.

-

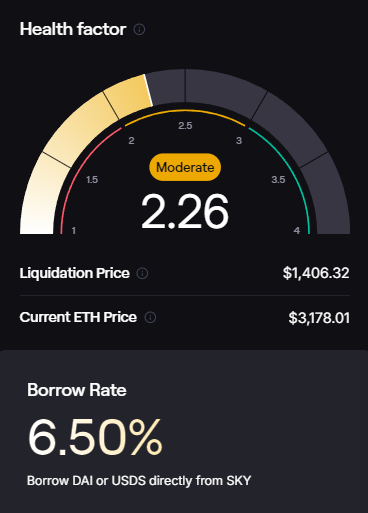

This will showcase the Health Factor, the Liquidation Price and the current Collateral Pricing for the position.

The Health Factor Overview

The Health Factor Overview

- The Health Factor is a measure of how close the position is to liquidation based on the current LTV. A Health Factor below 1 means the position can be liquidated. Users are responsible for keeping a Health Factor above 1, in order to avoid liquidation. The LTV of the position can change over time if the underlying collateral changes in value, and as debt accrues due to interest rates.

- Current Price shows the current market price of the collateral asset provided by the price oracle.

- If the price of the collateral asset reaches the Liquidation Price, the position can be liquidated.

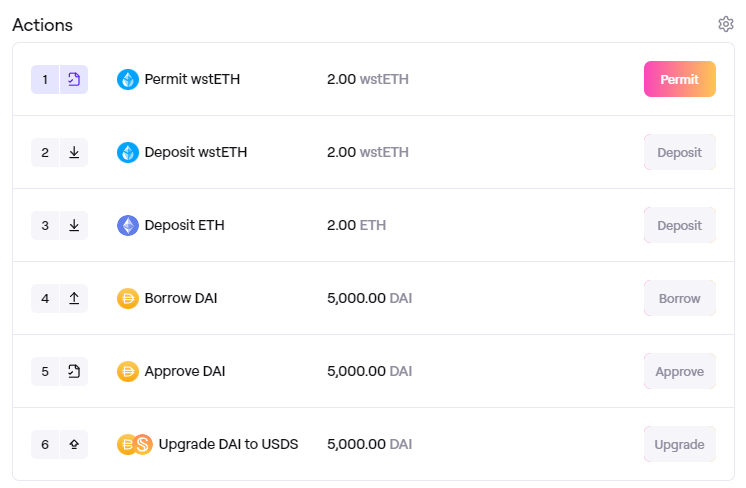

- The Actions section below shows the transactions necessary to create the borrow position. You must click the buttons to sign each transactions with the connected wallet.

Actions Window

Actions Window

- Token Permit/Approval: You must approve the deposit of the collateral token.

- Deposit: You deposit the collateral tokens into the borrow position.

- Borrow: You borrow the specified amount of assets.

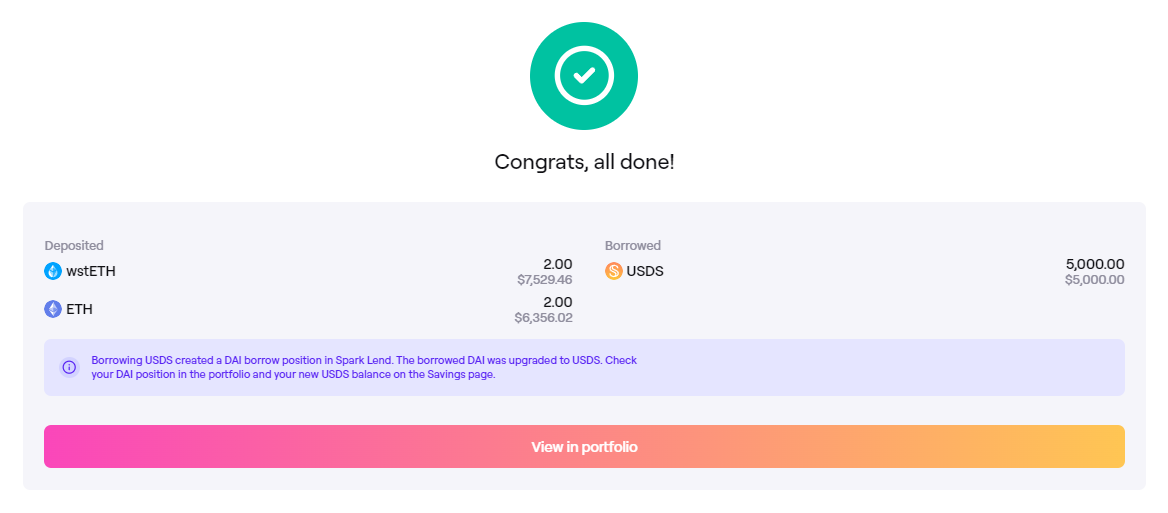

- Once every step is done, you will have received the borrowed Dai in your wallet, and a confirmation and overview of the actions. You can click on View in dashboard to view your new position.

Confirmation Window

Confirmation Window

FAQ

You can find frequently asked questions relating to collateral deposits and borrowing here: